The Peak Precedes the Pain | Protecting Retirement from Market Highs

The Peak Precedes the Pain: Why Your Retirement Strategy is Most Vulnerable at the Top

![[HERO] The Peak Precedes the Pain: Why Your Retirement Strategy is Most Vulnerable at the Top [HERO] The Peak Precedes the Pain: Why Your Retirement Strategy is Most Vulnerable at the Top](https://cdn.marblism.com/lYubKmo-G7g.webp)

You check your statement. You smile. Your portfolio is up 18% this year. Everything feels good.

But here's the question nobody wants to ask: When will it drop 10%, 20%, or more?

Market peaks don't ring a bell. They don't send a text. They just... happen. And they always precede the pain.

The Illusion of Safety at the Top

There's a strange psychological trap that catches almost everyone: when your account balance is highest, you feel safest. The number is big. The trend line points up. Your advisor says, "Stay the course."

But mathematically? You're standing on the edge of a cliff.

History tells us that major market losses happen every 6–7 years on average. We call it The 14-Time Trap because over a typical 40-year investing life, you'll face about 14 significant downturns. Some are quick corrections. Others are multi-year catastrophes.

The problem isn't if the next drop comes. It's when. And if you're at or near retirement when it hits, the damage is permanent.

Why Retirement Is Ground Zero for Peak Vulnerability

Let's be clear: peak vulnerability doesn't happen at 45 when you're still working and contributing to your 401(k). It happens at your retirement date , the moment you stop earning paychecks and start living off your portfolio.

Here's why that timing matters so much:

When you're working, a market crash is annoying but recoverable. You keep contributing. You buy shares "on sale." You wait it out.

But in retirement? You're doing the opposite. You're withdrawing money every month whether the market is up or down. If the market drops 20% in Year 1 of your retirement, you're now selling shares at depressed prices to fund your lifestyle. Those shares are gone. They can't recover. They can't compound. The loss is locked in.

This is called sequence of returns risk, and it's the silent killer of retirement plans.

The Math That Wall Street Doesn't Want to Show You

Here's a scenario that shocks most people:

Retiree A retires into a strong market, then experiences poor returns later.

Retiree B retires into a market crash, then experiences strong returns later.

Both portfolios earn the same average return over 20 years. Same stocks. Same allocation. Same long-term performance.

Guess what? Retiree B runs out of money first.

Same average. Different sequence. Completely different outcome.

Wall Street loves to talk about "average returns" because averages hide the danger. They smooth out the peaks and valleys into a nice, tidy number. But you don't retire into an average. You retire into a moment, and if that moment happens to be at a peak, you're taking the biggest gamble of your life.

The 14-Time Trap in Action

Let's revisit that 14-Time Trap concept.

Over the last 100 years, the market has experienced major corrections or crashes roughly every 6–7 years. Some examples:

1973–1974: –48%

2000–2002: –49%

2008–2009: –57%

2020: –34% (in 33 days)

2022: –25%

You see the pattern. Big gains, big losses. Peaks, then pain.

Now imagine you retire in 2007 with $1 million. You're thrilled. Your advisor shows you projections based on "historical averages." You're set for life.

Then 2008 hits. Your $1 million becomes $570,000. You still need to withdraw $40,000 that year to live. Now you're down to $530,000: and you've just locked in a 47% loss in Year 1 of retirement.

Even if the market recovers over the next decade, your account doesn't. You've been selling shares the whole time. The math never catches up.

This is why peak vulnerability is so dangerous. The higher you climb, the more you have to lose: and the less time you have to recover.

Feeling Good Is Not a Strategy

The scariest part? Most people don't realize they're at a peak until it's too late.

In 2007, people felt great. In 1999, people felt invincible. In early 2020, portfolios were hitting all-time highs.

Then gravity showed up.

Wall Street's advice during those times is always the same: "Don't try to time the market. Stay invested. Trust the process."

But here's what they don't tell you: that advice works great when you're 40 and accumulating wealth. It's a disaster when you're 65 and distributing it.

The rules change when you retire. The risk changes. The stakes change.

You can't "wait out" a downturn when you're taking withdrawals. You can't "buy the dip" when you're selling to pay bills. The accumulation playbook doesn't work in the distribution phase.

What Actually Protects You

So what's the alternative?

It's not about predicting the peak. It's about not needing the peak to feel safe.

Here are the strategies that actually work when you're facing sequence of returns risk:

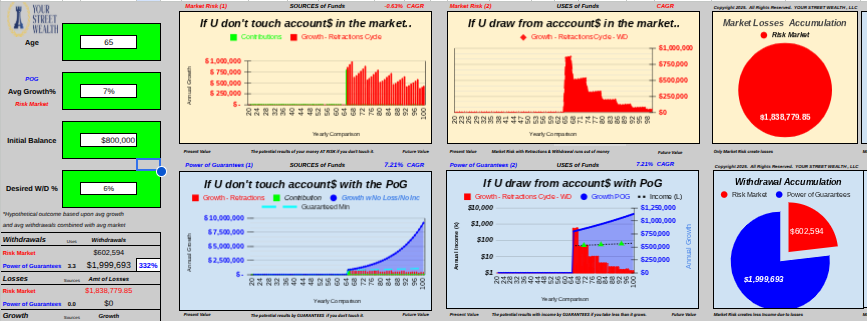

1. Guaranteed income solutions

Annuities, pension-style strategies, and guaranteed accounts don't care what the market does. They deliver predictable income whether the S&P 500 is up 30% or down 30%. You stop gambling on timing and start locking in certainty.

2. Rules-based withdrawal strategies

Instead of pulling the same amount every year regardless of market conditions, you adjust based on reality. When the portfolio is down, you pull less. When it's up, you pull more. This prevents you from selling at the worst possible time.

3. Separation of time horizons

Keep 3–5 years of living expenses in cash or short-term bonds. This gives you a buffer so you're not forced to sell stocks during a crash. You ride out the storm without locking in losses.

4. Diversification that actually matters

This isn't about owning "a mix of stocks and bonds." It's about owning assets that don't all move together: and making sure a portion of your wealth is completely insulated from market risk.

The Real Question

Here's what it comes down to:

Do you want a retirement plan that requires perfect timing, steady markets, and 30+ years of hope?

Or do you want a plan that works regardless of when the next crash happens?

Most people don't even realize they're betting on Option 1 until it's too late.

The peak feels good. It looks good on paper. But it's the most vulnerable moment in your entire financial life: and most retirement strategies are built like you'll never leave it.

You will.

The question is whether your plan is ready for what comes next.

Ready for clarity instead of confusion?

The Million Dollar Hour™ is your educational, one-on-one retirement review that reveals where your plan leads : not just where it's been.

👉 Schedule your session today.

Keywords

Market Peak Risk, Retirement Vulnerability, Sequence of Returns Risk, 14-Time Trap, Retirement Planning, Million Dollar Hour

👉 Schedule your session today.