Sequence of Returns Risk: 7 Mistakes That Ruin Retirement

Sequence of Returns Risk: 7 Mistakes You're Making (And How to Protect Your Retirement Savings from Market Crash)

![[HERO] Sequence of Returns Risk: 7 Mistakes You're Making (And How to Protect Your Retirement Savings from Market Crash) [HERO] Sequence of Returns Risk: 7 Mistakes You're Making (And How to Protect Your Retirement Savings from Market Crash)](https://cdn.marblism.com/ck-OkYKGp52.webp)

You've saved for decades. Your portfolio looks healthy. Your advisor says you're "on track."

Then the market drops 30% in your first year of retirement.

Suddenly, "on track" becomes "out of luck."

That's Sequence of Returns Risk (SORR) : and most retirees don't see it coming until it's too late. Here are the seven mistakes that turn a solid retirement plan into a slow-motion train wreck, and what you can do instead.

Mistake #1: Thinking Average Returns Matter More Than Timing

Wall Street loves to talk about "average annual returns." You'll hear things like, "The market averages 10% over time, so you'll be fine."

Here's the problem: Average returns mean nothing if the losses come first.

Two retirees can have identical 20-year average returns : one experiences gains early, the other takes losses early. The first retiree retires comfortably. The second runs out of money before age 80.

Why? Because when you're withdrawing money during a downturn, you're selling assets at their lowest point. Those assets never get the chance to recover.

The Fix: Stop planning around averages. Plan around guarantees. If your income doesn't depend on market performance, the sequence doesn't matter.

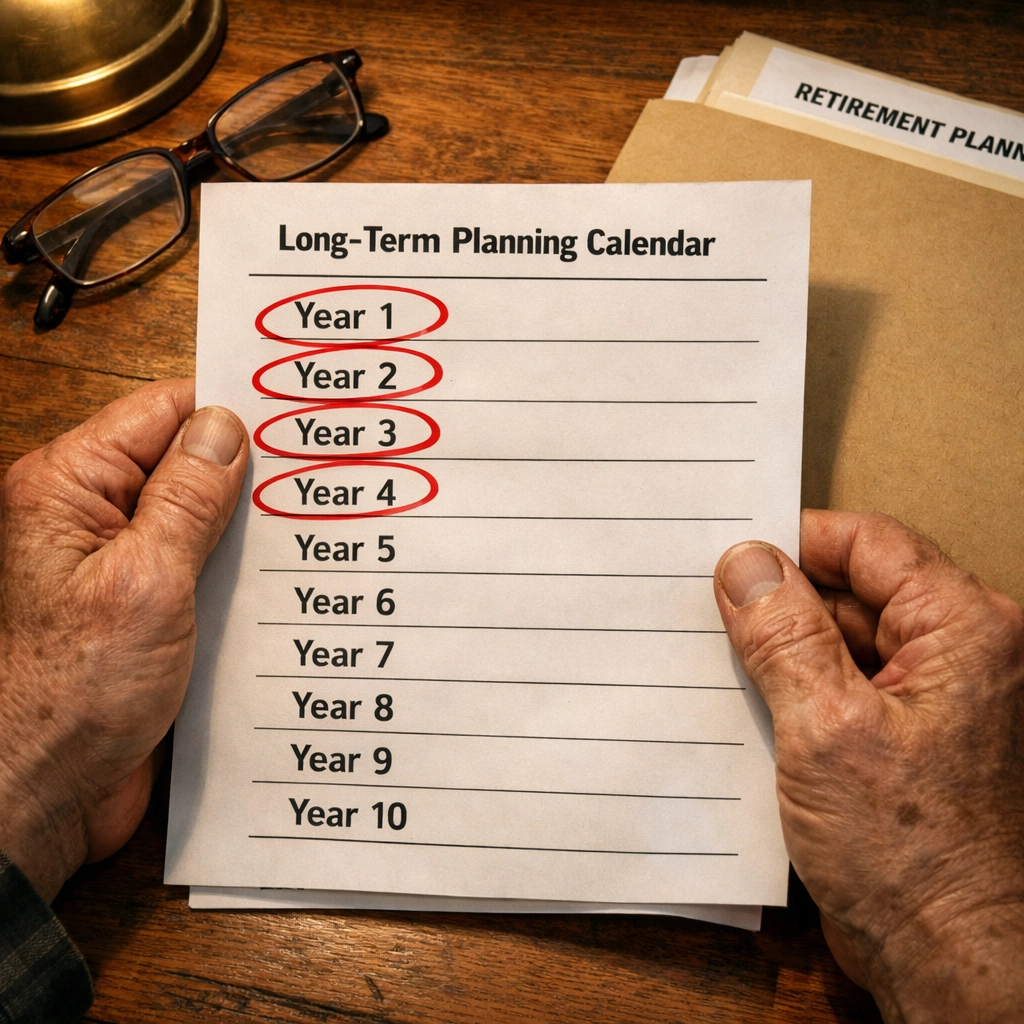

Mistake #2: Ignoring the First 10 Years

Research shows that 77% of your final retirement outcome is determined by what happens in your first 10 years after you stop working.

Let that sink in.

You could have 30 years of retirement ahead of you, but the market's behavior in the first decade will dictate whether you're sipping mai tais or rationing groceries.

Wall Street's advice? "Rebalance annually and stay diversified."

That's like telling someone to rearrange deck chairs on the Titanic.

The Fix: Lock in guaranteed growth during those first 10 years. If your money grows whether the market is up, down, or sideways, you've eliminated the risk entirely.

Mistake #3: Withdrawing the Same Amount Every Year, No Matter What

Most retirees are told to follow the "4% Rule" : withdraw 4% of your portfolio each year, adjust for inflation, and you'll be fine.

Except when the market crashes and your portfolio is suddenly worth 30% less. Now you're withdrawing 4% from a much smaller pile, which means you're selling a larger percentage of what's left just to get the same dollar amount.

This accelerates depletion. You're eating through the goose while she's sick, leaving even fewer eggs for the future.

The Fix: Use a strategy that adjusts withdrawals based on market conditions : or better yet, use guaranteed lifetime income that doesn't fluctuate with market performance.

Mistake #4: Staying "Aggressively Invested" Into Retirement

Your advisor probably told you to keep 60% or 70% in stocks "for growth."

That might work in your 40s. It's a disaster at 65.

When your portfolio balance is at its highest and you're starting to take withdrawals, you're at maximum vulnerability. A 20% market drop in year one isn't just a paper loss : it's real money you're forced to sell at a discount to cover living expenses.

Wall Street calls this "staying the course." I call it gambling with your grocery money.

The Fix: Reduce stock exposure as you approach retirement. Or, move a significant portion into guaranteed growth vehicles that don't depend on the market at all.

Mistake #5: Selling Low to Fund Withdrawals

Here's the cruelest part of SORR: When the market drops and you need $50,000 for the year, you have to sell more shares to raise that cash.

Let's say your portfolio was worth $1 million, and the market drops 25%. Now it's worth $750,000. To get your $50,000, you're selling roughly 6.7% of what's left : not 5%.

That means fewer shares remain to participate in any future recovery. You've locked in the loss.

The Fix: Have a separate, guaranteed income source that doesn't require you to sell anything during a downturn. Let the market recover while you live off guaranteed cash flow.

Mistake #6: Assuming "Time in the Market" Still Applies

"Time in the market beats timing the market" is gospel on Wall Street.

It's also completely irrelevant once you're withdrawing money.

That advice works during the accumulation phase : when you're contributing and compounding. But in retirement, you're in the distribution phase. You're taking money out. The math flips.

A 30% loss in year one of retirement is not the same as a 30% loss at age 40. At 40, you keep contributing and buying discounted shares. At 65, you're forced to sell those discounted shares to pay for life.

The Fix: Recognize that retirement is a different game. Stop playing by accumulation rules. Use strategies designed for distribution : specifically, ones that guarantee you won't lose ground.

Mistake #7: Not Having a Plan to Recover Lost Time

Wall Street's solution to SORR is simple: "Hope the market recovers."

That's not a strategy. That's a prayer.

Even if the market does recover, you've already sold shares at a loss to fund your lifestyle. Those shares are gone. They can't participate in the rebound. You've permanently lost wealth.

And worse : you've lost time. Every year spent in recovery mode is a year you're not moving forward. You're just digging out of a hole.

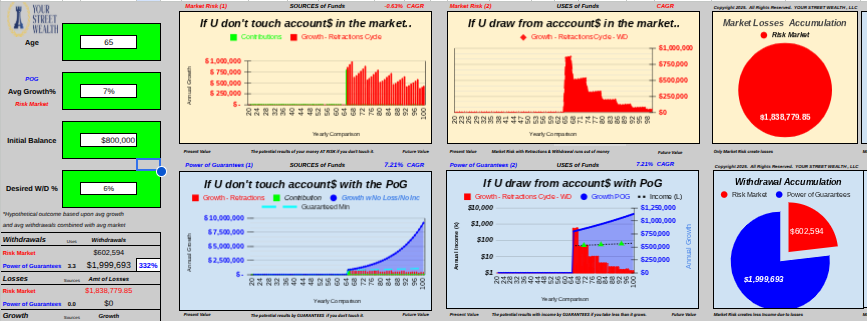

The Fix: Use a strategy that includes guaranteed growth and recovery of lost time. At Your Street Wealth, we build plans where downturns don't erase progress. Your income keeps flowing, your principal stays protected, and you don't spend years recovering : because there's nothing to recover from.

The Wall Street vs. Your Street Difference

Let's be blunt: Wall Street's approach to SORR is to acknowledge it exists, then tell you to ignore it and "stay invested."

That's not a plan. That's a gamble.🎲

At Your Street Wealth, we don't gamble with your retirement. We use rules-based planning with guarantees baked in. Your money grows whether the market cooperates or not. Your income doesn't depend on timing. And you don't spend the first decade of retirement white-knuckling through volatility.

We've written before about how the peak always precedes the pain. If you're retiring near a market high, the risk isn't theoretical : it's imminent.

The question isn't whether you'll face SORR. The question is whether you'll have a plan that protects you when it happens.

What to Do Next

If any of these seven mistakes describe your current plan, don't panic : but don't wait either.

SORR is most dangerous in the first few years of retirement. If you're still working or newly retired, you're in the critical window right now.

The good news? It's fixable. You can restructure your plan to eliminate sequence risk entirely, lock in guaranteed growth, and stop depending on market timing for your quality of life.

Ready for clarity instead of confusion?

The Million Dollar Hour™ is your educational, one-on-one retirement review that reveals where your plan leads : not just where it's been.

👉 Schedule your session today.

Keywords

Sequence of Returns Risk, SORR, retirement savings, market crash protection, retirement income planning, guaranteed retirement income, retirement withdrawal strategies, first 10 years of retirement, average returns vs timing, sequence of returns, 4% rule alternatives, guaranteed growth strategies, retirement distribution phase, protect retirement savings, market volatility retirement, safe retirement planning, Your Street Wealth