Sneak Peak Inside Million Dollar Hour - What Your Retirement Report Looks Like

A Sneak Peek Inside the Million Dollar Hour™: What Your Retirement Report Should Actually Look Like

Let’s talk about something nobody wants in retirement:

Water on the floor.

Not the dramatic kind. The slow, sneaky kind. You don’t notice it at first… and then you’re standing in a mess wondering where it all went.

That’s how a lot of retirement planning works today. Money goes out. Markets go up and down. Fees leak. Timing hits wrong. And somehow, after decades of “investing,” the plan still feels like… a puddle with a prayer.

Most retirement reports don’t help. They show up as 50 pages of charts, fund names you don’t recognize, and phrases like “Monte Carlo simulation.” You flip a few pages and think, “Cool… so am I good?” Then you file it away and hope.

That’s not planning. That’s hoping with extra steps.

The Million Dollar Hour™ report is built around a simple visual idea:

Are your dollars behaving like water dumped on the floor… or like water flowing through a system that actually gets you where you’re trying to go?

No jargon. No fluff. Just your numbers, clear visuals, and a rules-based way to tell if your retirement strategy is a mess… or a reliable stream.

Water on the Floor vs. Water in a System

Picture this.

Assets at Risk = Pouring Water on the Floor

Traditional Wall Street planning often looks like this:

You pour water (your money) onto a floor (the market) with no container and no guardrails. It spreads everywhere. Some evaporates (fees + inflation). Some seeps into cracks (bad timing). And when you need income? You’re basically trying to scoop water off the floor with a coffee mug.

That’s Assets at Risk:

exposed to market drops

exposed to bad timing (especially early retirement)

withdrawals happen whether the market is up or down

“average returns” look nice… until real life shows up

Fully Performing Assets = Guided, Contained Water

Now picture a simple, guided system: water flows through a pipe into a tank, with valves and backstops. It’s contained. It’s measurable. It’s reliable.

That’s the concept behind Fully Performing Assets:

rules-based

designed for income

protected from losses

built to keep working even when the market doesn’t cooperate

The Million Dollar Hour™ report visually shows the difference between these two worlds using your actual numbers—not “average retiree” math. When your strategy is a leaky floor, it shows up fast. When it’s a contained system, you can actually plan around it.

The “How Much Water Did I Lose?” Question

Here’s where it gets real.

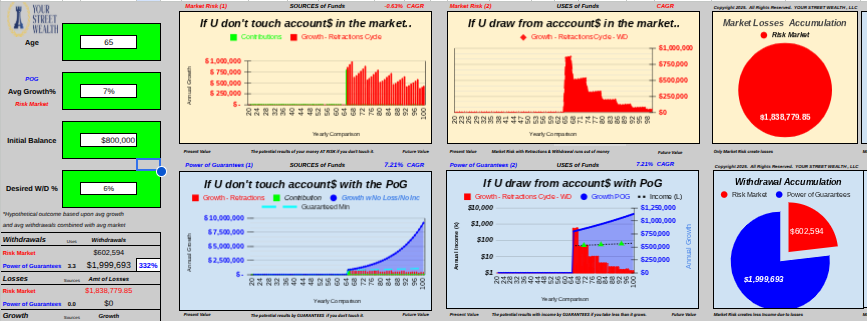

In the sample report (based on a 65-year-old with $800,000 starting balance), the “assets at risk” approach shows $1.83 million lost to the market over the course of retirement. That’s water that got poured out… and never made it into a usable container.

Meanwhile, the “fully performing” approach accumulates $1.99 million through protected, rules-based growth and income design.

That’s a potential $3.82 million gap between “mess on the floor” and “reliable stream.”

Will your numbers match that exact scenario? Maybe not. The point isn’t to predict next year’s market—it's to stop pretending a leaky floor is a retirement income system.

Because in retirement, you don’t just need “growth.” You need usable money, on purpose, on time.

The 5 Pillars (AKA: The “Pillar Test”)

This is the part I wish every retirement statement came with.

Because once you see these five pillars, it’s just… common sense. Like—who wouldn’t want Never Lose Money and a Stepped Up Floor?

If you’re trying to create reliable retirement income, these are the safeguards that matter. They’re the difference between:

Assets at Risk: pouring water on a flat floor and hoping it doesn’t soak into the rug, and

Fully Performing Assets: a guided, contained system that keeps the water flowing where it’s supposed to go.

Here’s the Pillar Test—formatted so it actually pops:

GPV: Guaranteed Present Value (The floor you stand on today)

GFV: Guaranteed Future Value (The floor you're promised tomorrow)

UCG: Uncapped Growth above GFV (The upside with no ceiling)

NLM: Never Lose Money (The safety net that's always there)

SUF: Stepped Up Floor (Locking in gains so you never go backward)

Why the order matters (Pillar Architecture)

Here’s the sneaky part: it’s not just having pillars—it’s how they’re built together. I call it Pillar Architecture.

Change the order, change the identity of your retirement.

If NLM (Never Lose Money) is an afterthought behind UCG (Uncapped Growth), you basically just have Assets at Risk. That’s “let’s chase upside and hope we can patch the leaks later.” (Spoiler: the water usually hits the rug first.)

If you have NLM but no UCG, you’ve got a Non-Performing Asset. Safe? Sure. But it can feel like a boring bank product that doesn’t really move the needle against inflation and rising costs.

If you only focus on one pillar, you’re being myopic about your future. Retirement is long-term. A real pillar is built to hold weight for decades—not just look good on a statement this year.

Who wouldn’t want protection and upside and the ability to lock in progress?

That’s why the Million Dollar Hour™ report doesn’t just list these five. It shows how they work together—in the right sequence—so your money stops behaving like water on the floor and starts acting like a reliable stream.

So What’s Actually in the Million Dollar Hour™ Report?

It’s visual on purpose. Because you can feel the difference between a puddle and a pipeline.

Inside the report, you’ll see things like:

side-by-side comparisons of “assets at risk” vs “fully performing assets”

year-by-year projections (so you can see the waterline rising or draining)

income timing (when your paychecks start and how consistent they are)

the exact places time and wealth get lost when the market drops

But the big thing—the thing you won’t see anywhere else—is this:

We run your actual retirement strategy through the 5 Pillars.

Not hypothetically. Not with generic assumptions. With your numbers.

That’s where you see, in black and white, whether your plan is:

money scattered across the floor (hard to control, hard to predict), or

money moving through a guided system (clear rules, clear outcomes)

If something doesn’t click, that’s what the session is for. We walk through it together, page by page, until it makes sense.

Why You Need to See Your Numbers (Not Someone Else’s Water Story)

You can read about retirement strategies all day. You can watch videos, listen to podcasts, and collect opinions like baseball cards.

But until you see your specific situation laid out in front of you, it’s all theory.

The Million Dollar Hour™ takes your:

current savings

retirement age

monthly spending target

Social Security estimate

current “Wall Street plan” details

…and runs the math.

Then we apply the Pillar Test so you can see exactly where you stand on the spectrum:

Assets at Risk (water on the floor), or

Fully Performing Assets (water in a guided, contained system built for reliable income)

And yes—people are usually surprised.

Some realize they’re in better shape than they thought. Others find out they’ve been counting on “average returns” to do the heavy lifting… while the floor quietly keeps getting wetter.

This Isn’t a Sales Pitch. It’s a Spill Check.

Let me be clear: the Million Dollar Hour™ isn’t about selling you a product. It’s an educational session. You’re going to see your numbers, understand your options, and walk away with a report you can actually use.

If it turns out your current plan is solid and passes the Pillar Test? Awesome. Keep doing what you’re doing.

If it turns out your current plan is basically pouring water on the floor and calling it “a strategy”? At least you’ll finally see it—clearly—and you can choose to fix it.

Because you can’t make a good decision without good information. And most people are trying to plan a 30-year retirement with a few statements and a hope that “the market averages 8%.”

Hope is not a container.

Ready to See Your Report?

The Million Dollar Hour™ report is waiting for you. It's visual, honest, and built around your life: not some hypothetical retiree in a textbook.

No 50-page snoozefest. No jargon overload. Just the truth about where your money goes, how long it lasts, and what you can do about it.

If you've ever looked at your retirement statement and thought, "I have no idea if this is enough," this is your answer.

Keywords: retirement income planning, retirement plan review, Million Dollar Hour, guaranteed retirement income, retirement forecast, sequence of returns risk

Ready for clarity instead of confusion?

The Million Dollar Hour™ is your educational, one-on-one retirement review that reveals where your plan leads — not just where it’s been.

👉 Schedule your session today.