The 'Free Cheese' Trap: Why Wall Street's Myths are Costing You Millions

The 'Free Cheese' Trap: Why Wall Street's Myths are Costing You Millions

![[HERO] The 'Free Cheese' Trap: Why Wall Street's Myths are Costing You Millions [HERO] The 'Free Cheese' Trap: Why Wall Street's Myths are Costing You Millions](https://cdn.marblism.com/qHEnIZIZ1u5.webp)

You've probably heard the saying: "The only free cheese is in the mousetrap."

Wall Street hands out free cheese like it's going out of style. Free seminars. Free financial reviews. Free portfolio snapshots. Free advice from brokers who get paid when you buy.

And it keeps you right where they want you: fat, dumb, and happy: until the market crashes and you realize the cheese was bait all along.

The Architecture Wall Street Won't Show You

I spent years architecting Asset Liability Management (ALM) for multi-billion-dollar banks. The whole game came down to one simple formula:

How much do your assets earn (INCOME) vs. how much do your liabilities cost you (EXPENSES)?

That's it. That's the foundation of profitability. And it's the exact same architecture that should be driving your retirement strategy: but almost nobody talks about it.

Banks don't guess. They don't "hope for the best." They architect systems that guarantee profitability over decades, not quarters.

Your retirement deserves the same treatment. But Wall Street doesn't sell architecture. They sell hope dressed up as "diversification."

FIAAR: The Architecture of Retirement Success

The Million Dollar Hour™ Retirement Strategy is built on the same principles I used when turning around struggling public and private companies. It's called FIAAR:

0% Floor: You never lose money. Period.

AI (All maturing assets produce Income): Every dollar works. No dead weight.

AR (Allocation of Risk declines as they age): As you get older, your money gets safer: not riskier.

This isn't a product. It's a structural framework. And it's built on the same 5 Pillars we talked about in the last post:

GPV – Guaranteed Present Value

GFV – Guaranteed Future Value

UCG – Uncapped Growth above GFV

NLM – Never Lose Money

SUF – Stepped Up Floor

But here's the kicker: most people have never even heard of these pillars. And even if they have, they don't understand that the order matters.

If you prioritize UCG (growth) before NLM (never lose money), you have Assets at Risk. If you have NLM without UCG, you have Non-Performing Assets sitting in a bank earning nothing.

A true pillar is something that lasts for the long-term: not just a good quarter or a good year. If you're focused on just one pillar, you're myopic about retirement. And myopia in retirement planning is expensive.

The Four Categories of Assets (And Why You've Never Heard of Them)

When I did turnarounds for struggling companies, I categorized assets into four buckets. It revealed everything about why a company was failing: or thriving.

Here's how it applies to your retirement:

1. AAR – Assets At Risk

This is your typical brokerage account. Stocks, mutual funds, ETFs. They go up. They go down. You hope they go up more than they go down. But hope isn't architecture.

2. NPA – Non-Performing Assets

Money sitting in a savings account earning 0.5%. It's "safe," but it's dead weight. It produces no income. It doesn't compound. It just… sits there. Losing to inflation.

3. UPA – Under-Performing Assets

CDs. Bonds. Annuities that say they're guaranteed but lock you in with no growth. They're better than nothing, but they're not optimized. They lack the full pillar architecture.

4. FPA – Fully Performing Assets

These are the unicorns. They have all five pillars in the right order. They never lose money. They produce income. They compound. They step up every year. And they're protected from market crashes.

Most people have a portfolio that's 80% AAR, 15% NPA, and 5% UPA. Zero FPA.

And then they wonder why they're running out of money in retirement.

Wall Street's "Architecture" Is a Myth

Here's the dirty secret: Wall Street has no architectural strategy for your retirement.

They have products. They have sales pitches. They have "target-date funds" that shift you into bonds as you age (which sounds smart until you realize bonds lost 20% in 2022).

But they don't have a rules-based, lifetime architecture designed to protect you from tornadoes and hurricanes.

They're focused on the next quarter. The next earnings call. The next bonus cycle.

You? You're thinking about the next 40 years.

And yet, curiosity has left the building. People are so enthralled with Wall Street's myths: "the market always goes up," "just stay the course," "you can't time the market": that they don't want to unlearn what they've been taught.

Why? Because they don't know an Architecture of Retirement Success even exists. They have no basis to learn. No framework to compare. No question burning inside them that demands an answer.

So they stay stuck. Eating the free cheese. Waiting for the next market crash to wipe out another 30% of their savings.

Only 2% Succeed on Wall Street. 100% Can Succeed on Your Street.

Let's talk numbers.

Only 2% of people are successful on Wall Street over the long haul. The rest? They buy high, sell low, panic during crashes, chase performance, and retire with less than they need.

But everyone has the opportunity for success on Your Street: where compounding works for you, not against you. Where the pillars protect you. Where the architecture is designed for a lifetime, not a quarter.

The myths are powerful. They're emotional. They're psychological barriers that keep people trapped.

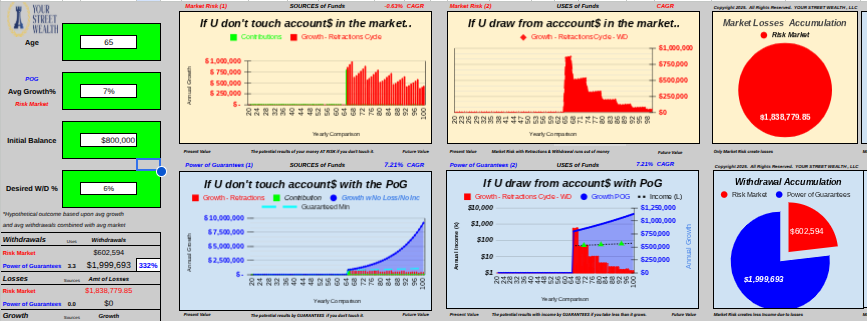

You'd think a side-by-side comparison of Assets at Risk vs. Fully Performing Assets over 40 years would convince anyone to change their Allocation of Risk each year.

But it doesn't. Because the free cheese is too comfortable.

The $3.8M Question: Would You Pay $100k to Find a $3.8M Gap?

Here's a thought experiment:

If I told you that for $100k, I could show you a guaranteed doorway to finding a $3.8M gap in your retirement plan: would you pay it?

Of course you would. That's a 38x return. You'd sign the check on the spot.

But here's the problem: Wall Street has trained you to expect everything for free.

Free advice. Free reviews. Free seminars. Free cheese.

And now, when someone shows up with a real solution: a real architectural framework that costs money to build: you balk. Because you're special. Because you've been eating free cheese your whole life.

But the free cheese is the trap. It's keeping you stuck. It's costing you millions.

How to Lose a Million You Don't Even Have Yet

Let’s kill a myth right now: you don’t have to be a millionaire to lose a million dollars.

Because the biggest theft in retirement planning usually isn’t your current account balance. It’s your future compounding.

Wall Street loves to act like a market loss is just “temporary” or “on paper.” And sure: you can sometimes earn it back.

But what you can’t earn back is time. And time is the ingredient that turns regular money into retirement money.

When your money is sitting in Assets At Risk (AAR) and the market takes a bite out of it, you don’t just lose dollars. You lose the years those dollars were supposed to compound for you.

The math Wall Street hopes you never run

If you lose $10,000 at age 40, that’s not a “$10,000 loss.”

That’s a chunk of your retirement bucket that just got erased before it had 25–30 years to grow up.

Depending on your timeline and return assumptions, that $10,000 could have become $100,000+ by the time you’re actually trying to live on it.

So when Wall Street says, “It’s just a 10% dip,” what they’re really saying is:

> “We just stole a slice of your future self and called it normal.”

“Millionaires in training” (and they don’t even know it)

This is exactly how regular people end up with a massive gap: not because they were reckless… but because they were never taught how compounding really works.

A bunch of “small” hits over a few decades:

a drawdown here,

a panic sell there,

a lost decade of flat performance,

fees quietly siphoning off gains,

and a portfolio that stays in AAR far too long…

…adds up to a retirement plan that looks fine on statements but is missing the one thing you can’t replace: future growth.

That’s how someone can wake up at 60 and realize they’re staring at a $3.8M gap without ever realizing they were basically a “millionaire in training” the whole time.

Why this keeps happening

Wall Street relies on you not knowing how money works:

If you don’t understand compounding, you’ll shrug off losses.

If you don’t understand sequence risk, you’ll accept “stay the course.”

If you don’t understand architecture, you’ll keep buying products.

And while you’re focused on this quarter’s statement, they keep taking payments from your future self.

That’s why we obsess over rules-based, safety-first architecture in the Million Dollar Hour™: because protecting your retirement isn’t about chasing the biggest number. It’s about protecting the time that creates the number.

What's Needed: Curiosity About Your Fears

The people who succeed in retirement aren't the smartest. They're not the richest. They're not even the most disciplined.

They're the most curious.

They ask: "What am I afraid of? What keeps me up at night? And how do I architect a solution that relieves those fears and opens a doorway to a better future?"

If you're curious about your fears: about running out of money, about market crashes, about leaving your spouse with nothing: then the Million Dollar Hour™ is the doorway.

It's not free. And it shouldn't be.

Because if it were free, it would be more cheese in the mousetrap.

Instead, it's an educational, one-on-one retirement review that shows you the architecture you're missing. The pillars you don't have. The $3.8M gap you didn't know existed.

And it gives you the roadmap to close it.

Keywords

how much do i need to retire

retirement income calculator

sequence of returns risk

retirement income planning

guaranteed retirement income

guaranteed lifetime income

annuities pros and cons retirement

best retirement income strategies

retirement plan review

protect retirement savings from market crash

Ready for clarity instead of confusion?

The Million Dollar Hour™ is your educational, one-on-one retirement review that reveals where your plan leads — not just where it’s been.

👉 Schedule your session today.